As a business, our culture is what sets us apart. Creating social and cultural added value, we champion a positive working culture with a focus on ensuring everyone feels a genuine sense of belonging.

Through our corporate values we bring our culture to life and encourage our people to demonstrate these by creating value for society. We also support our people’s wellbeing, not only at work, but in their wider lives.

At LGT, we support charitable causes nominated by our colleagues who can select three new satellite charities close to their hearts each year, and then every two years, we select a new core charity partner.

Our current core charity partner is Demelza, who deliver extraordinary care to extraordinary children facing serious or life-limiting conditions. The team at Demelza has worked tirelessly alongside us in our fundraising efforts. Along with supporting the day-to-day operations, our fundraising has helped to fund two new healthcare assistants, a speech therapist and a nurse in the last 24 months.

This year, we are incredibly proud to be supporting Gympanzees, Neuroendocrine Cancer UK and Urban Uprising as our satellite charities. Colleagues who nominated the charity then lead on organising the fundraising activities, with the money raised being matched by the firm. Recent activities have been the Seven Hills of Edinburgh challenge to raise money for Urban Uprising and the Three Peaks challenge to fundraise for Neuroendocrine Cancer UK.

In addition to these elected charities, we support Skills Builder, who help to bridge the skills gap through classroom-based models, improving prospects for employability after school. Only 37% of teachers think the current education system prepares young people well for life and only 24% of teachers think essential skills are currently taught sufficiently in education.1 We work closely alongside the charity, with LGT colleagues recently volunteering in the June Career Insights Week, sharing advice and skills in an interactive session with primary school age children.

In 2018, LGT Wealth Management’s Enrich Committee was founded to improve the wellbeing of our people both in the workplace and in their personal lives.

Alongside the implementation of the wellbeing strategy throughout the year, the committee run an annual Wellbeing Week which is not only dedicated to raising awareness of this important topic, but the various events are organised to tackle areas of wellbeing in the hope that there is something for everyone to get involved in.

"We believe it should not just be about a wellbeing week or month once a year where we pay ‘lip service’ to our people’s wellbeing, but an ongoing programme based on employees’ wants and needs."

- Debbie Hofford, Founder of Enrich Committee

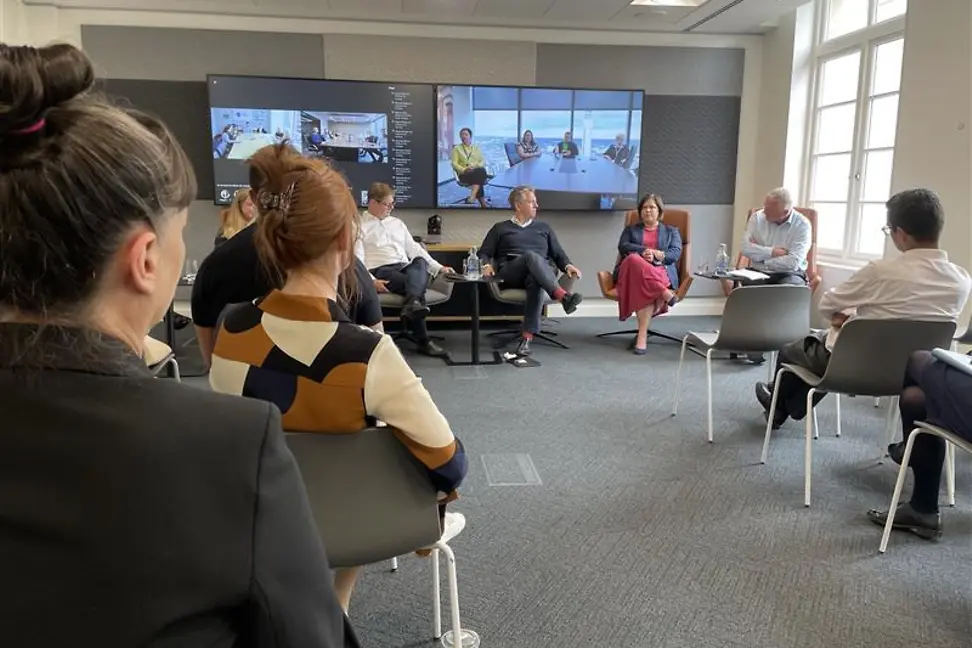

During 2024’s Wellbeing Week, our Enrich committee, hosted a tailored programme with thought provoking panel discussions, opportunities for connection with colleagues and activities to encourage mindfulness and reflection.

An open and honest conversation with members of our Management Board was hosted by Ben Snee, CEO, discussing how the leadership team manage periods of stress, tackle a bad day and offer valuable insights into how they boost their own wellbeing.

Read our 2024 Impact report, which is a reflection of our collective efforts during 2023 to progress the sustainability agenda. It provides an overview of our sustainability initiatives, spanning environmental stewardship, social responsibility and quality corporate governance. Our commitment to contributing towards a sustainable future for all is the essence of how we endeavour to create value for our four stakeholders: our clients, our owner, society and our colleagues alike.

[1] Skills Builder https://www.skillsbuilder.org/file/essential-skills-tracker-2024

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.