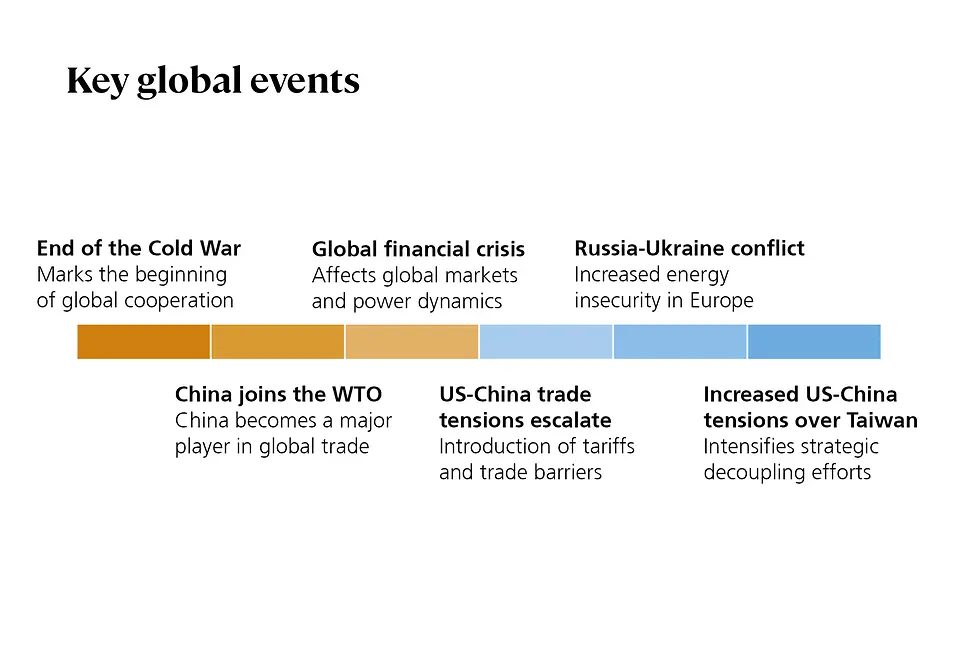

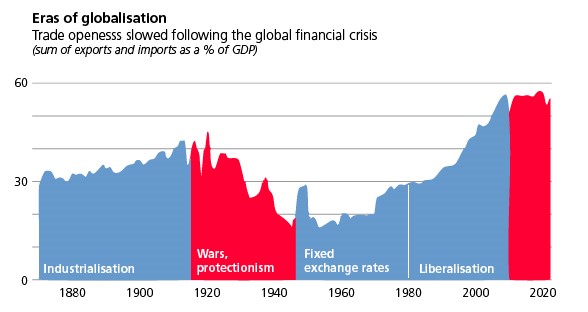

The period following the end of the Cold War in 1989 was a relatively stable time when conflict and intimidation between global powers was rare. A rules-based system was built upon the Washington Consensus, which fostered mutual co-operation and led to a transformational collapse in trade barriers as countries embraced globalisation, the EU expanded and China joined the WTO.

It shows how dramatically things have changed that markets had minimal reaction to the conflict in the Middle East, Vladimir Putin’s nuclear rhetoric, or mounting concerns that China may invade Taiwan. Likewise, large-scale civilian deaths or major retaliatory incursions by Ukrainians into Russia are largely unreported. Sadly, we have become accustomed to a world in which aggression, sanctions and trade barriers are the norm. In this article, we explore the reasons for rising geopolitical uncertainty and explain our approach to investing in an uncertain world.

After multiple decades when the US and China peacefully respected one another from a distance, China’s emergence as a geostrategic player and an increasingly dominant economic competitor has forced the US, EU and UK to reconsider their positions. The notion of “strategic decoupling”1 has gained traction, particularly as US-China tensions heightened during Covid and the Russia-Ukraine war. Sanctions, tariffs and trade barriers are increasing, heightened by Trump’s re-election.

As the West re-evaluates their relationship with China, they can also take lessons from the nation too. Former ECB President Mario Draghi discussed this topic in an EU report on competitiveness, arguing that nations must learn more from China, which retains its natural resources for its own industries with its long-term plans and prosperity in mind. The global focus on strategic reserves of natural resources, including rare metals and semiconductors essential for technology and military hardware, has forced leaders to reconsider their stance on China, the dominant producer of these materials. As countries seek to boost reserves, this will have significant implications on global supply chains and investment strategies.

Europe has faced its own set of unique challenges. Russia’s invasion of Ukraine sent energy prices in Europe soaring. Car manufacturers have also been hit by China’s growing influence in the electric vehicle (EV) space, where cars sell for as little as $10,000. On top of this, China’s dominance in rare earths puts it in an enviable position when it comes to energy security, as rare earths are an important component in batteries, solar panels and wind turbines. The EU needs to secure their energy supply and protect their markets, but they are behind the curve, and they are not unified so this could prove challenging. A forward-looking, highly selective approach aligned with key trends will be critical. Identifying emerging Asian EV innovators like BYD, rather than relying on VW’s past successes, is likely the best way forward.

Many businesses are moving manufacturing closer to home for security and economic purposes. This recalibration is especially relevant as Taiwan tensions escalate and the semiconductor arms race prompts firms and countries to re-assess their operational risks. TSMC, the world’s largest manufacturer of semiconductors, has all but completed building its first plant in the US, at great expense and following political pressure and financial incentives from the US government.2 TSMC has subsequently committed to building two more plants on the site over the next decade.3 The US has banned exporting high-end semiconductors4 to China, demonstrating once again the political nature of the industry.

The implications of decoupling extend beyond immediate economic impacts; they signal a broader shift in global power dynamics. As companies adapt, the reconfiguration of trade relationships will likely create new opportunities and challenges for investors. India, Mexico and Thailand have all been immediate beneficiaries of supply chains shifting away from China, but whether this will continue under the Trump administration, which is keen to prioritise the US domestic economy, remains uncertain.

A company specific example is HSBC, which announced plans to restructure its operations into four distinct units, notably splitting into ‘East’ and ‘West’ divisions, set to take effect from 2025. One unit will align with China’s alternative to the SWIFT payment system, a significant pivot in global banking practices.5 George Soros teaches the principle that for every big top-down idea, one should look for a bottom-up expression. HSBC’s move exemplifies this, signalling how financial institutions are approaching geopolitical realities.6 A one-size-fits-all approach is no longer suitable, therefore the businesses that are adaptable will be best placed to benefit.

A significant development in this shifting landscape has been the emergence of the Global South, which broadly consists of Africa, Latin America, the Caribbean, Asia (excluding Japan and South Korea) and Oceania (excluding Australia and New Zealand). This ambitious and cohesive economic bloc, exemplified by the BRICS7 summit held in October 2024, which was headed up by de-facto leaders Xi Jinping, Vladimir Putin and Narendra Modi, admitted another 13 partner states. The summit’s declaration was widely seen as posturing, with few clear plans or commitments for implementation. For investors, the long-term investment significance of BRICS will depend on its ability to challenge existing paradigms but also its members’ commitment to meaningful cooperation.

As these nations seek to assert their influence, the investment implications could be profound, especially for the US dollar as the world’s primary currency. These disenfranchised nations may seek to displace the dollar as the reserve currency, a trend fuelled by the perception that the US has weaponised the currency through its continued control, although this displacement is unlikely to happen in the near future. However, as those who have spent time in Asia can testify, companies such as Alipay8 or WeChat are growing in influence in Asia, a region that has 60% of the world’s population and a growing middle class with significant spending power. This means the US and its companies may face increasing competition.

Following the re-election of President Trump, we are at an inflection point. US foreign policy has started to change rapidly, which will impact both domestic and global economic policies. There has already been a flurry of executive orders and promises of tariff implementation, with neighbouring countries like Canada and Mexico on the initial receiving end. The strategic use of tariffs can be a complex tool in international relations and, if employed as a means to an end, rather than an end in itself, can serve as a form of leverage to achieve broader diplomatic or economic goals. Their implementation by the US could therefore potentially alter the trajectory of current geopolitical tensions.

The US leadership change is likely to have a profound short-term impact on certain regions like the Middle East, China, the EU and Russia, amongst others, but time will tell if this will be positive, negative or even lasting in the long term.

We cannot assume Trump’s second term will be the same as his first.

Trump’s new and younger team in JD Vance, Tucker Carlson, Elon Musk, RKJ and Vivek Ramaswamy will throw in some curveballs. If there is anything we know about Trump, it is that money talks and if he believes that closer relations with China or ending the Russia-Ukraine war will help ‘Make America Great Again’, then nothing should be discounted.

Investing in global, quality businesses is still a key component of our investment framework. However, as the world continues to fracture geo-strategically into distinct spheres of influence, a globally oriented portfolio built solely upon a collection of blue-chip businesses with global earnings but with no consideration for geopolitical trends, will no longer suffice. To simply invest in the whole basket of ‘Emerging Markets’ will be too generic. There are too many different countries with different return drivers, demographics and loyalties to put them all in the same basket. Instead, a greater emphasis on regional allocations will become essential. Diversifying across various geographies, with some exposure in Asia or emerging markets, some in the US and a handful of European companies is vital.

Within fixed income, we anticipate there will be opportunities to arbitrage the different interest rate regimes within regions. For example, while the US has started cutting interest rates, Japan has started to raise rates. China is prioritising fiscal expansion, while the UK is heading towards fiscal discipline. These differences will provide opportunities for nimble investors.

As geopolitical tensions continue to evolve, understanding their financial implications will be crucial for investors. Rising uncertainty, coupled with strategic decoupling and emerging power dynamics in the Global South, presents both challenges and opportunities. By embracing a diversified investment strategy that accounts for regional and sectoral distinctions, investors can better navigate this complex landscape and position themselves for success in an uncertain world. We believe that by being nimble, active and highly selective within our regional allocations, keeping focused on the long term and investing alongside a collection of the best-in-class regional fund managers, we are well placed to benefit from dispersions in returns between different companies, regions or sectors despite geopolitical uncertainty.

[1] https://www.thediplomat.com/2024/10/de-risking-vs-strategic-decoupling-understanding-harris-and-trumps-approaches-to-economic-security/

[2] https://www.tsmc.com/static/abouttsmcaz/index.htm

[3] https://www.cnbc.com/2024/12/13/inside-tsmcs-new-chip-fab-where-apple-will-make-chips-in-the-us-.html

[4] https://www.cnbc.com/2024/09/06/us-china-quantum-chip-related-export-controls.html

[5] https://www.hsbc.com/news-and-views/news/hsbc-news-archive/we-are-simplifying-to-accelerate-our-strategy

[6] https://www.reuters.com/business/finance/hsbc-appoints-pam-kaur-first-female-cfo-2024-10-22/

[7] BRICS is an acronym for an association of five major emerging economies: Brazil, Russia, India, China, and South Africa

[8] Founded by Alibaba in 2004, Alipay is a third-party mobile and online payment platform. Alipay overtook PayPal as the world’s largest mobile (digital) payment platform in 2013. As of June 2020, Alipay serves over 1.3 billion users and 80 million merchants. According to the statistics of the fourth quarter of 2018, Alipay has a 55.32% share of the third-party payment market in mainland China, and it continues to grow.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.