Successful family-owned businesses show that the keys to longevity are not size or fast growth, but a commitment to quality, adaptability, and family values.

Business life-expectancy isn't what it used to be. The S&P 500 Index tracks the 500 largest companies in the USA, and according to research by McKinsey and Company, the average lifespan of a company listed on the S&P 500 was 61 years in 1958. Today, it is less than 18 years.

Why is this? There are many possible explanations, one of which is that size might be detrimental to business longevity. With a growth-at-all-costs mindset and corporate cultures that prioritise shareholder returns above all else, there is a risk that companies can expand themselves into extinction.

To understand what makes businesses endure through decades, or even centuries, it's useful to look beyond the current corporate giants and explore the world's oldest operating companies.

Japan stands out here, where a study by the Bank of Korea found that over 50,000 active companies were founded over 100 years ago, and that 89% of them had fewer than 300 employees. It's no surprise, therefore, that the oldest company in the world still in business is a Japanese construction firm, Kongō Gumi, which was established in 578 AD to build a Buddhist temple. The company continues to build, repair, and maintain Buddhist temples today.

If we turn our eyes to Europe, we see a similar picture of smaller businesses enduring longest. The five oldest operating companies in Europe are:

St. Peter Stiftskulinarium in Salzburg is Europe's oldest restaurant with a history of over 1200 years. First mentioned in A.D. 803, it initially served as a monastery cellar. In the 11th century, it became a centre for wine trading.

From 1527, it was gradually developed into a restaurant under Abbot Chillian Pitricher. At the beginning of the 20th century, Abbot Willibald Hauthaler modernised the rooms. Some sources even claim that Faust once spent the night here.

The Staffelter Hof vineyard in Kröv on the Moselle is one of the oldest businesses in the world. It originally belonged to the Abbey of Stavelot and was first mentioned in A.D. 862, when King Lothair II gave land and vineyards to the monastery. For centuries, the vineyard supplied the abbey with wine and transported it over 140 kilometres into the Ardennes. After secularisation in 1803, the estate was privatised. During the 19th and 20th centuries, the estate was repeatedly divided among the heirs, reducing the size of the vineyards to 0.3 hectares by 1949. The vineyard was restored through expansion measures, and by 2012 it had grown to nine hectares. In 2014, Staffelter Hof converted to fully organic viticulture.

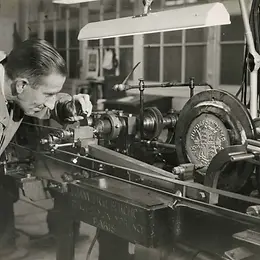

The Monnaie de Paris was established by Charles II in A.D. 864 by the Edict of Pîtres. It became the most important mint in the kingdom of France and consolidated royal control over currency production. In the Middle Ages, there were several mints throughout France, but their number fluctuated due to economic and political changes.

Under Louis XIV, coinage was standardised in the late 17th century, helped by screw press technology. By 1870, there were only three mints, and since 1878, Monnaie de Paris has been the only active mint. In 1973, the Pessac facility was established to modernise currency production, allowing the Paris location to focus on medals, collector coins and objets d'art.

The Royal Mint, established in A.D. 886, is the official coin producer of the United Kingdom. Based at the Tower of London for over 500 years, the Royal Mint centralised coin production under Alfred the Great. Over the centuries, it has adapted to economic and technological change, ensuring the reliability of UK currency. In 1968, to support the move to the decimal currency, the Royal Mint moved to a state-of-the-art facility in Llantrisant, Wales, where it continues to mint coins for the UK and international markets. Today, it is a government-owned corporation that has expanded beyond currency to produce bullion, commemorative coins and luxury items, combining craftsmanship with innovation.

Sean's Bar in Athlone, Ireland, is officially recognised by Guinness World Records as Ireland's oldest pub, with a foundation date of around A.D. 900. It is thought to have been founded by Luain Mac Luighdeach near an important ford on the River Shannon, leading to the growth of the settlement of Áth Luain (now Athlone).

Historical accounts and a detailed record of ownership attest to its ancient origins, but architectural and archaeological studies suggest that the present building dates from the 17th or 18th century and may incorporate materials from earlier structures. During renovations in 1970, wicker walls dating back to the 9th century were discovered, along with old coins used for bartering, which are now on display at the National Museum and in the pub itself.

Looking at this list, what stands out is that these five companies represent only two sectors: money, and food and beverages. Both The Royal Mint in England and the Monnaie de Paris are mints, which produce coins and notes, and are now government-owned. The other three are a restaurant, a winery, and an Irish pub - all business models successfully replicated across the globe.

But these particular examples don't reveal many generally applicable or useful lessons on business longevity. Instead of looking at specific industries, we can learn more about business endurance by analysing family-owned businesses that have successfully weathered economic downturns, societal upheavals, and technological disruption for generation after generation.

Research suggests that the common denominator among successful, long-lasting family businesses is an ability to adapt, innovate, and maintain high quality standards, while still adhering to strong family values, and fostering a healthy corporate culture.

Achieving these requires a vision that prioritises long-term sustainability over short-term profits, and allows the business to invest in its infrastructure and workforce. It also requires empowering and involving younger generations. When members of the next generation feel a sense of ownership and responsibility, and have the capabilities to match, they are more likely to contribute to the business's success and durability.

Transferring ownership from one generation to the next can be risky, especially when family ties are prioritised over individual qualifications. For example, the Bank of Korea study found that companies in Japan passing ownership based solely on familial relationships, such as from father to son, were less likely to survive. Conversely, businesses that selected professional CEOs based on merit, rather than family connections, tended to enjoy greater success and longevity.

A family-owned business still operating today that exemplifies longevity and an ability to adapt, innovate, and thrive is the Avedis Zildjian company. Established in 1623 in Constantinople (now Istanbul, Turkey), this is one of the oldest operating family-owned businesses in the world.

The company was founded by an Armenian metalsmith and alchemist named Avedis Zildjian, who discovered a unique method for producing metal alloys that could make musical sounds without shattering. The cymbals made by Zildjian became well-known among the Ottoman Empire's musicians, and even the royal court embraced them.

By the early 19th century, the need for high-quality cymbals in the emerging orchestral and military bands increased, strengthening the firm's revenues. Then in 1929, Zildjian relocated to the United States, seeking opportunities in the growing American music scene. Jazz and big band music were rising in popularity, creating demand for high-quality percussion instruments.

Throughout the mid-20th century, with the development of rock and roll, Zildjian expanded its product lines, introducing new designs to match the different styles of the evolving music landscape. Famous drummers like Ringo Starr of the Beatles helped position Zildjian as the go-to cymbal brand for professional musicians, a reputation that endures as its cymbals, drumsticks, and mallets are used by some of the top drummers and percussionists around the world.

Today, Zildjian remains family-owned, with its headquarters in Norwell, Massachusetts, and offices in London and Singapore. Its board of directors is also made up of Zildjian family women in the 14th and 15th generations.

While giant companies may have dominated the landscape for decades in the past, the shorter lifespans of contemporary companies highlight the fact that size and rapid growth are insufficient to ensure longevity, let alone market domination.

The enduring success of family-owned enterprises like Zildjian reveals essential lessons on how to foster long-term sustainability. By balancing tradition with a willingness to innovate, family businesses demonstrate that the key to longevity lies in cultivating a culture that values quality, adaptability, clear-eyed family values, and a future-oriented vision for success.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.