They established what many consider to be the most successful investment partnership of all time: Berkshire Hathaway Inc. What can today's investors learn from them?

"Ignore the pundits. Buy businesses, not stocks. Believe in America."

Warren Buffett's investment advice is deceptively simple. His legendary letters to Berkshire Hathaway's shareholders are odes to the folksy shrewdness of his native Omaha, Nebraska. He has penned more than 50 of them since 1964, when he bought Berkshire, which was then a failing mid-western textile business.

The letters appeal to the common sense of "investors who trust Berkshire with their savings without any expectation of resale," as he put it in his 2023 epistle. He was talking to people "who save in order to buy a farm or rental property, rather than people who prefer using their excess funds to purchase lottery tickets or 'hot' stocks."

Yet common sense alone can't explain Berkshire's truly extraordinary track record. In the almost six decades between 1965 and 2023, its portfolio posted a 19.8 per cent compound annual gain. This was nearly double the 10.2 per cent return of the S&P500, with dividends included. Indeed, Berkshire remains one of the most coveted stocks in the world.

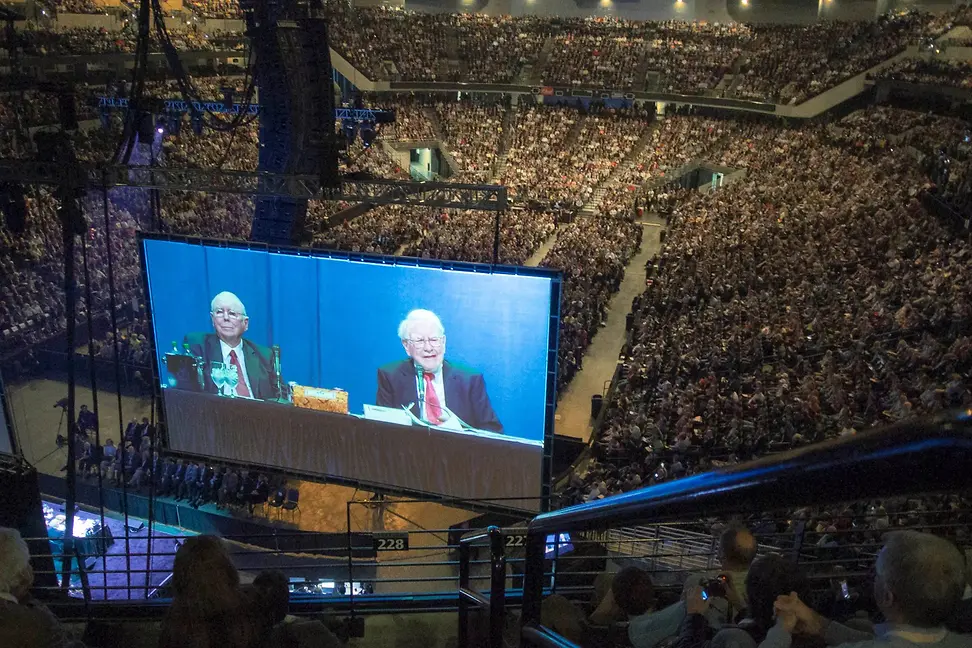

None of this would have been possible as Buffett, the "Oracle of Omaha", has often remarked, without the investment savvy of his old friend, fellow Omahan and business partner Charlie Munger, who died just shy of his 100th birthday on 28 November 2023. "Charlie was the 'architect' of Berkshire’s success," according to Buffett, "and I acted as the 'general contractor' to carry out the day-by-day construction of his vision."

Munger's vision was a combination of what he called "worldly wisdom" and a systematically logical approach to stock picking that was characterized, above all, by the ability to ditch ideas that no longer worked. Munger attributed that knack to careful consideration of what he termed the "Lollapalooza" effect, by which he meant the convergence of multiple biases, desires, and effects (or models) that tend to drive people (in this case, investors) in the same direction and lead to disproportionately large and irrational outcomes.

He often drew an analogy with bridge, a card game at which both he and Buffett excelled, to demonstrate the importance of model interaction. Investors familiar with Berkshire's convention and annual meeting weekends may recall Munger and Buffett dropping in for a hand of bridge after the always-lively Q&A sessions.

Many will also be familiar with the financial insights contained in "Poor Charlie's Almanack", a tribute to Ben Franklin whose "Poor Richard's Almanack", first published in 1732, Munger much admired. Munger's book was written, much like Buffett's shareholder letters, in the style of a fireside chat.

After Munger joined Berkshire as vice chairman in 1978, his vision became the company's investment creed. Buffett abandoned the value-investing convictions learned from his former hero and Columbia Business School teacher Benjamin Graham, avoided cheap but failing stocks (like the original Berkshire), and sought only "wonderful businesses purchased at fair prices". What's more, Buffet has claimed, whenever "my old habits resurfaced," Charlie "jerked me back to sanity."

Buffett calls the dirt-cheap stocks that he once specialised in "cigar butts"; a reference to the fleeting pleasure of a final, free puff. "It took Charlie Munger to break my cigar-butt habits and set the course for building a business that could combine huge size with satisfactory profits," Buffett wrote in Berkshire's 50-year anniversary letter in 2014. And he was true to his word.

The Berkshire that Buffett will bequeath to his successors is a behemoth of first-class businesses spanning the insurance, railroad, retail, energy, and manufacturing sectors. It's worth in excess of USD 900 billion. Of the more than 50 stocks in its portfolio, the top ten are US companies, and most are iconic names: Bank of America, Apple, Kraft Heinz, Occidental Petroleum, American Express, Chevron, and Citigroup.

Most, moreover, are long held. Berkshire has owned American Express since 2001, and Coca-Cola since 1988. Top stocks also tend to be dividend growers. Coke, for instance, has increased dividends for more than 50 consecutive years.

For all its successes, however, Berkshire has struggled to find new and worthwhile investments in recent years. "There remain only a handful of companies in this country capable of truly moving the needle…and they have been endlessly picked over by us and by others," Buffett acknowledged in his 2024 letter to shareholders. "Outside the US, there are essentially no candidates that are meaningful options for capital deployment at Berkshire."

The company spent billions acquiring insurance conglomerate Alleghany in 2022, and truck-stop operator Pilot Flying J in early 2024. But those outlays barely dented Berkshire's cash pile, which hit a record USD 167.6 billion at the end of 2023, up USD 39 billion over the course of the year.

Thanks to much stiffer competition (especially from private equity) Berkshire has become a big investor in its own shares and routinely turns to buybacks when it cannot find appealing investments in the public markets. As Buffett ruefully observed, "size did us in."

Even so, Berkshire still does rather better than the average US company, and Buffett is in no doubt as to why: extreme fiscal conservatism. "There is one investment rule at Berkshire that has not and will not change," he proudly declared in 2024: "Never risk permanent loss of capital."

With a nod, no doubt, to his own personal financial success (he was named the seventh-richest person in the world in 2024, with an estimated net worth of almost USD 135 billion) Buffett told shareholders that owning just one of the "rare enterprises" that can deploy additional capital at high future returns "and sitting tight…can deliver wealth almost beyond measure."

That was also, of course, what Charlie Munger believed. And while the pair have often been criticised by activists for paying insufficient attention to issues like climate change and boardroom diversity, their rock-solid commitment to safeguarding shareholders' interests has certainly paid off for the many who trust them to manage their savings.

Investing, after all, isn't about instant gratification. It's about long-term success. Small wonder that Munger and Buffett rank among the most respected investors ever.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.