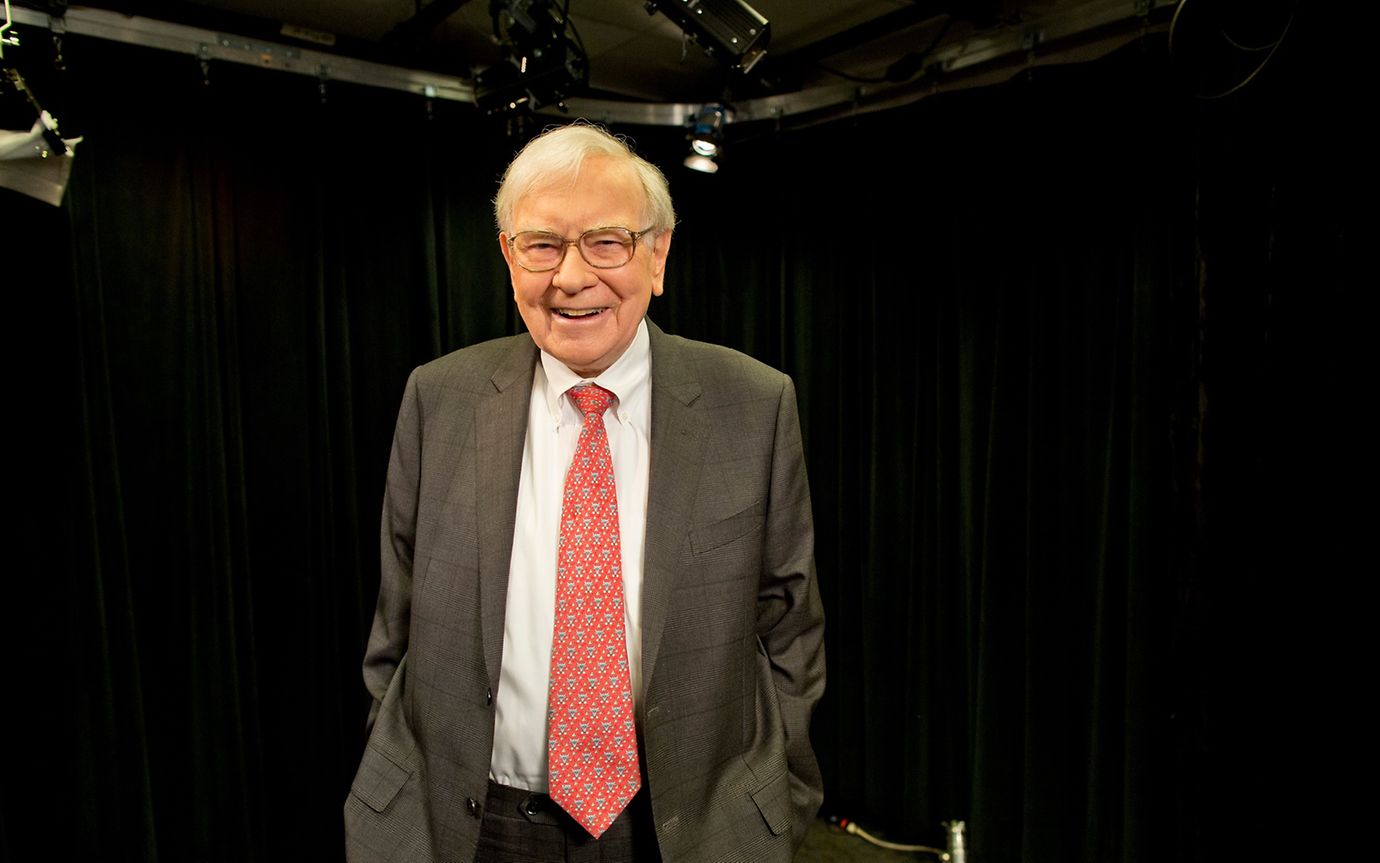

Legendary investor Warren Buffett attributes much of his success to The Intelligent Investor, a book by Benjamin Graham that was first published in 1949. In today’s multimedia world, getting through its over 600 pages can seem like quite a challenge – but it can pay off.

Warren Buffett bought his first stock when he was eleven. At the age of 13, he filled out his first tax return, and at 19, he discovered his investing bible: The Intelligent Investor. The book, which was first published in 1949, was written by his professor Benjamin Graham.

Since reading The Intelligent Investor, Buffett has closely adhered to Graham’s principles. And it has obviously served him well; the “Oracle of Omaha”, who is now over 90, is widely considered the most successful investor of the last 50 years.

That’s why I’ve always thought there must be merit to Graham’s advice. And so, a few weeks ago, my curiosity finally got the better of me and I bought the book. I was full of enthusiasm when I started reading it, and lapped up the foreword by Warren Buffett. It’s interesting and sets the bar very high.

But with every page I read, I became increasingly worried about the pages that were still ahead. I had to keep pinching myself to keep motivated. I felt like a high school student struggling through Faust, Part I. I was fully aware that I was holding an important piece of writing in my hands – but the language constantly reminded me that the book had been written many decades ago.

Benjamin Graham worked to keep his book up to date until the end of his days. He tested his theories again and again, questioned himself and introduced new data. He would therefore likely have approved of the fact that the newer editions contain comments from the financial journalist Jason Zweig. Sometimes, these comments are even more insightful than Graham’s own words. But above all, they show that Graham’s assessments were often right on the mark.

Ultimately, however, The Intelligent Investor was likely less illuminating for me than it was for Warren Buffett. And that is probably due in no small part to the book’s success. When it was first published, Graham’s insights were groundbreaking. The book laid the foundations for value investing, an investment strategy that aims to identify undervalued stocks using metrics such as price-to-earnings ratio (P/E ratio). His arguments were so convincing that they can be found on just about any reputable financial website. However, this widespread popularity means the book is unlikely to contain any surprises for experienced traders.

To find out whether this book continues to provide a relevant introduction to financial markets in the present day, I asked my 19-year-old son to read it. His conclusion was that “With a bit of effort, someone with little prior knowledge of the subject is able to understand it and extract the key messages. The wisdom imparted by Graham is still relevant today. But he would probably have been very much against a number of the more recent trends in stock markets.”

High-frequency trading, cryptocurrencies, structured products and exchange-traded index funds (ETFs) would probably have caused Graham’s eyes to pop out of his head. There is no way he could have imagined these developments. And that makes it all the more astonishing that many of his principles have remained so timely and relevant.

Benjamin Graham was an analyst, which is reflected in the logical structure of his book. He explains what he considers to be an intelligent investor – namely the opposite of a speculator who always follows the herd. He introduces readers to capital markets and he outlines strategies for different types of investors. What may slightly irritate European readers is his focus on the American stock market (it should be noted, however, that this is the market for which the most comprehensive data exists). In addition, Zweig’s sometimes extensive comments seem at times more like a homage to Graham than a factual update of his work.

One of the advantages of Graham’s book is that you don’t have to read it from start to finish. Instead, you can go to specific chapters and consult the “father of fundamental analysis” on selected topics.

But even the “intelligent investor” got one thing wrong. Graham did not feel that gold could protect the purchasing power of the US dollar. He believed that, in contrast to shares, gold was an unproductive asset and criticised the fact it does not generate profits. That said, if you have the ability to invest like Graham and his most renowned disciple Warren Buffett, you probably don’t really need gold in your portfolio to make a fortune.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.