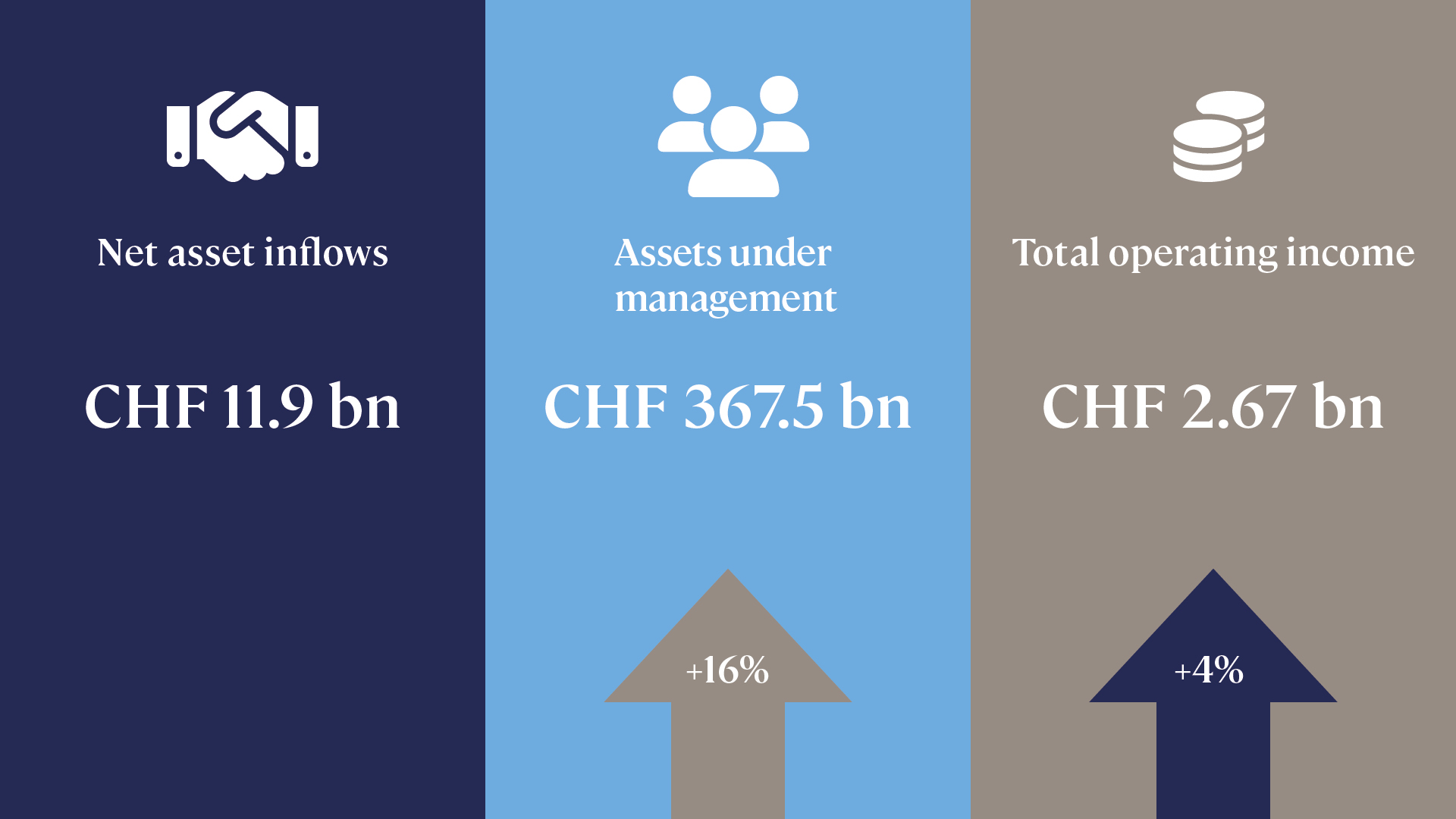

Following another year of growth, LGT has reported a 16% increase in assets under management (AUM). Despite ongoing geopolitical and economic uncertainties, the Group’s financial stability and long-term approach have continued to drive resilience and success. This week, we speak with LGT Wealth Management CEO Ben Snee to discuss the key drivers behind this performance and what’s next for LGT in 2025.

Ben Snee: Last year presented numerous geopolitical and economic challenges, with shifts in global market conditions proving difficult to forecast. However, the stability of LGT’s business model and long-term approach mean that we can invest into our offering, when others are fearful, and stay the course in spite of challenging market conditions.

In addition to the solid results reported, the business continued to grow. We are delighted that the integration of abrdn Capital Limited (aCL) was successfully completed in 2024, following the acquisition in 2023. Its results have been reflected in LGT’s results since September 2023.

Client trust is paramount to us and we remain dedicated to delivering the highest level of care and a personalised service to all our clients, whether with us for many years or those who have recently joined the LGT family.

The resilience and long-term approach of LGT should be a comfort to clients in today’s volatile world, as should its robust financial strength and global reach. We are, as always, extremely grateful to our valued clients and their ongoing support of the business.

Ben Snee: Owing to solid results in 2024, the business has continued to invest in our technology platforms, enhancing our IT infrastructure and digitalisation, which in turn improves our clients’ digital experience. We are focused on leveraging technological advances, including generative artificial intelligence, to improve efficiencies and deliver an exceptional experience to our clients.

We are dedicated to providing our clients with an excellent service and ensuring that we deliver good investment outcomes, in alignment with their financial objectives.

Ben Snee: Underpinned by our private ownership, entrepreneurial spirit and a rigorous investment strategy, we remain committed to creating long-term value for all stakeholders. We empower our teams to work with conviction to achieve tangible results and our global investment perspective positions us to explore diverse asset classes, sectors and geographies, driving growth in spite of macroeconomic volatility.

Our clients remain at the heart of what we do, with our enterprising mindset fostering continuous innovation and investment. Through this commitment, we will continue to deliver exceptional service and robust returns.

Find out more in the press release.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.