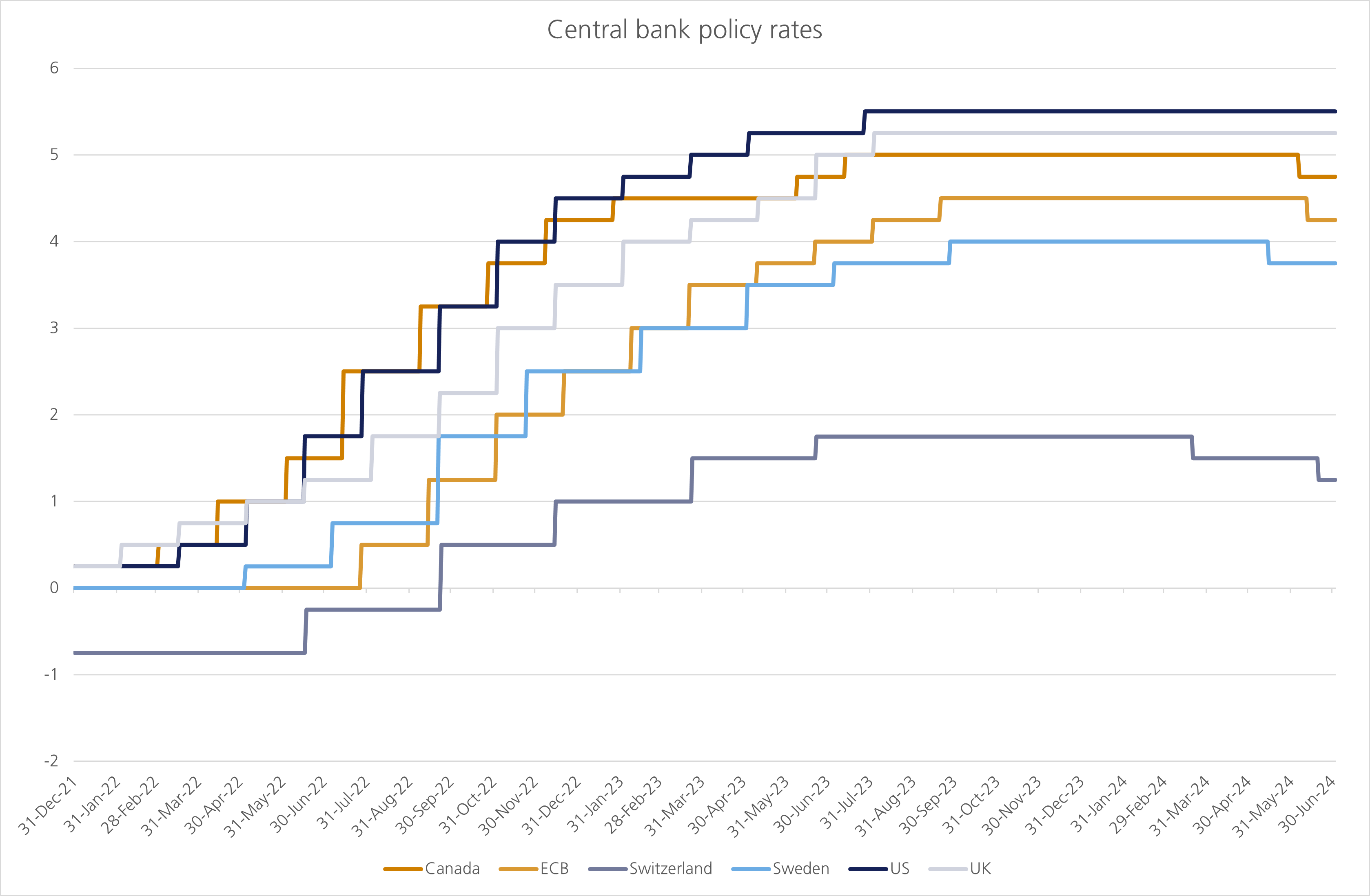

Markets have generally slowed down expectations of the pace of rate cuts as data had continued to signal stronger than expected inflation. However, the Fed did indicate earlier this week that inflation is coming down. Despite pushing back expected rate cuts, equity markets continued to push towards all-time highs in the second quarter, buoyed by US technology companies and the ongoing exuberance surrounding artificial intelligence (AI).

Although the European Central Bank (ECB) lowering interest rates in its June meeting was expected, it is noteworthy that interest rate cutting in individual countries is also underway, with central banks in Sweden, Switzerland and Canada all cutting rates.

On the political front, the UK and France saw both leaders call snap elections, with the Labour party securing a landslide victory this morning in the UK’s general election.

Markets have gyrated between one Fed rate cut and two this year. Although the Fed indicated it is on the right path towards disinflation, rate cuts remain unlikely anytime soon given ongoing price pressure concerns and the robust jobs market. This glacial pace of cuts means timing remains uncertain. The Bank of England (BoE) indicated in June it is more comfortable cutting rates and will likely start in August.

Regional differences will widen the gap between central banks. The Fed has significant influence, so it is likely central banks elsewhere will be more cautious and favour ambiguity over clear guidance.

The ECB had been signalling for months it was due to cut interest rates amid declining inflation and a sluggish economy. Consequently, it opted to cut rates by 0.25% to 3.75% in June.

Although the ECB became the first major developed market central bank to lower rates, the number of future rate cuts remains uncertain. The ECB will rely on data and analyse the inflation outlook before proceeding with future cuts. Europe’s economic recovery has been uneven, with southern European nations outperforming industrialised northern countries.

After a surprise increase in April, the US Consumer Price Index (CPI) moderated,1 indicating inflation is headed in the right direction. Bond yields followed suit, with 10-year Treasuries reaching 4.7% early in the quarter before falling to 4.4% by quarter-end. Despite positive CPI developments, the Fed indicated markets should only expect one cut this year.

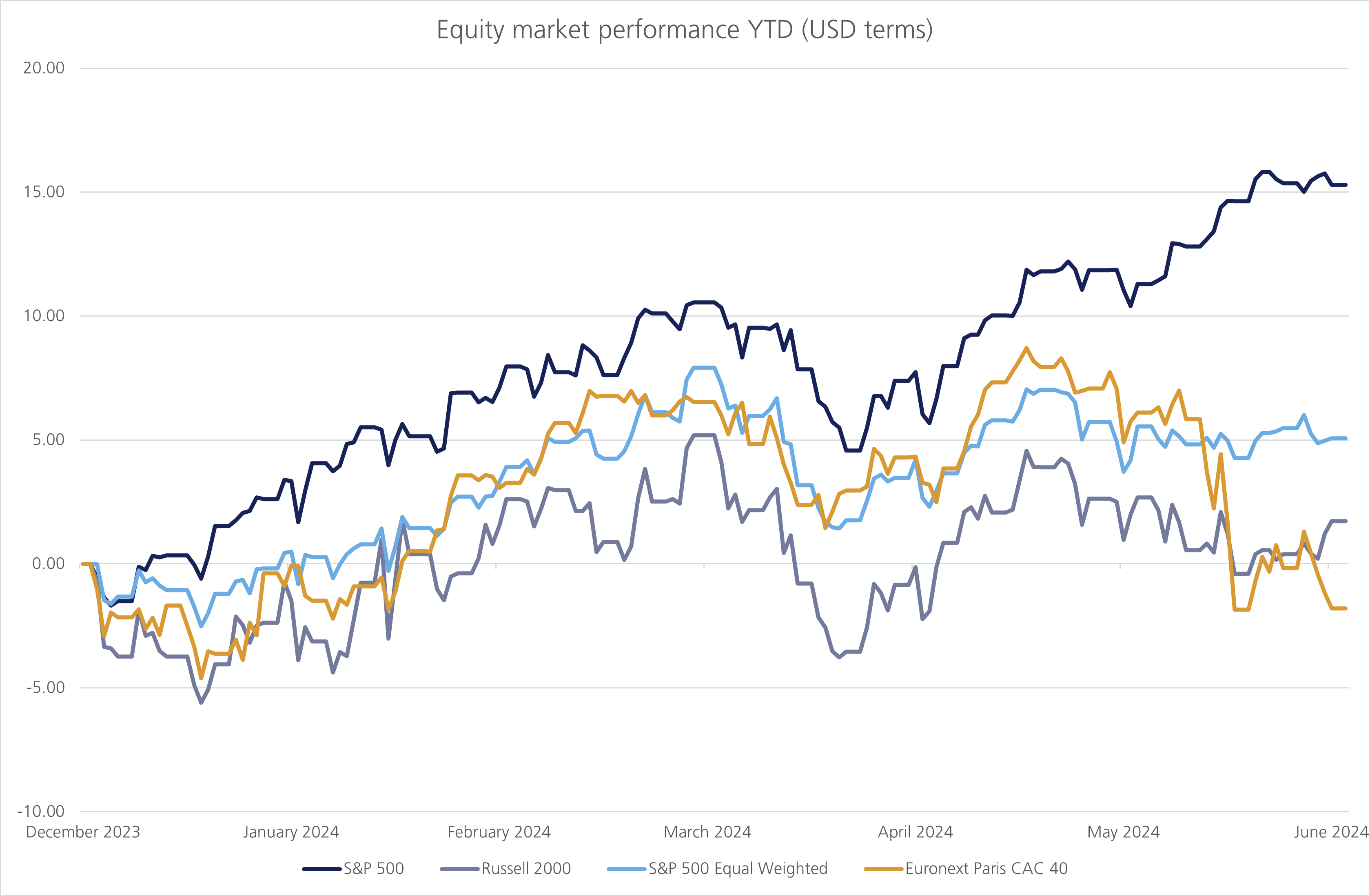

After a slight pullback in May, US equity markets continued to hit record highs, lifted by Nvidia, Apple and Microsoft, with Nvidia briefly overtaking Microsoft in June to become the world’s most valuable company with a market capitalisation of $3.3 trillion.2

The small number of companies with high levels of growth in the markets was even more pronounced this quarter, as Nvidia rose 37% while the S&P 500 gained 4.3%. Nvidia is responsible for some 35% of the S&P 500’s gains since the start of this year. Keeping with technology and AI-related themes, Apple and Microsoft also rose 23% and 6% respectively in the quarter, further boosting the S&P 500’s returns. In comparison, the equal weighted S&P 500 index, meaning that stocks are weighted according to their total market capitalisation (or size), fell 2.6% in the quarter, clearly indicating a handful of companies continue to drive the indices.

We expect something is likely to give in coming quarters. History tells us that hot sectors should not be chased at any price, but we do believe there is a place for these companies, albeit in a well-diversified, high-quality portfolio comprising of different asset classes. The Small Cap index, as measured by the Russell 2000, fell 3.3% over the quarter, further highlighting the narrowness in the markets.

UK Prime Minister Rishi Sunak’s decision to bring forward the general election to 4th July stunned market participants. Labour won the general election by a landslide, but markets showed limited reaction to the news, as polls predicted the Labour victory for months and with limited fiscal headroom, policy changes are likely to be marginal. In the US, the first presidential debate brought forth fresh concerns over President Joe Biden’s health.

In early June, the European Parliamentary elections showed surging support for right-leaning parties, with President Emmanuel Macron calling a snap national election in France. The French CAC 40 fell over 6% following Macron’s announcement and spreads on French and German bonds reached levels not seen since 2017.3 In the first round of the French parliamentary election on 30th June, Marine Le Pen’s National Rally party secured approximately 34% of the vote, with Macron trailing in third place. However, she is not projected to win an absolute majority, which brought relief to investors ahead of the second round on 7th July.4

In India, Prime Minister Narendra Modi lost his outright majority for the first time in a decade, and will now focus on forming a coalition government, which means passing important reforms will likely be more challenging. In Mexico, Claudia Sheinbaum’s landslide victory sent the peso and Mexican equities falling, as markets feared more extreme policies.5

Attempts to boost growth in Asia

The Hang Seng Index’s April rally quickly fizzled out, but it still finished the three-month period up 9%. China unveiled wide-ranging measures to stimulate its ailing property market, but this is not expected to be sufficient to boost the economy materially.6 The Shanghai Composite fell 1.3% over the quarter, while Japan’s equity market paused for breath. The Bank of Japan (BoJ)’s reluctance to take material action resulted in the yen falling 5.9% against the dollar in the quarter to reach the weakest level since 1986. This puts further onus on the BoJ to raise rates sooner.

As elections conclude and global governments take office and form post-election policies, this should help settle the tone and provide clarity around the evolving political landscape in the second half of the year. That said, the US election is not until November, so uncertainty will remain.

In the post-pandemic world, markets are increasingly influenced by fiscal policies. Consequently, we remain attuned to political risks while constructing portfolios. We continue to monitor these developments closely, but our focus is on quality companies that can withstand political turbulence and deliver solid returns over the medium to long term.

[1] Bureau for Labor Statistics

[2] Bloomberg

[3] Bloomberg

[6] CNN, https://edition.cnn.com/2024/06/17/business/china-property-price-record-slump-intl-hnk/index.html

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.