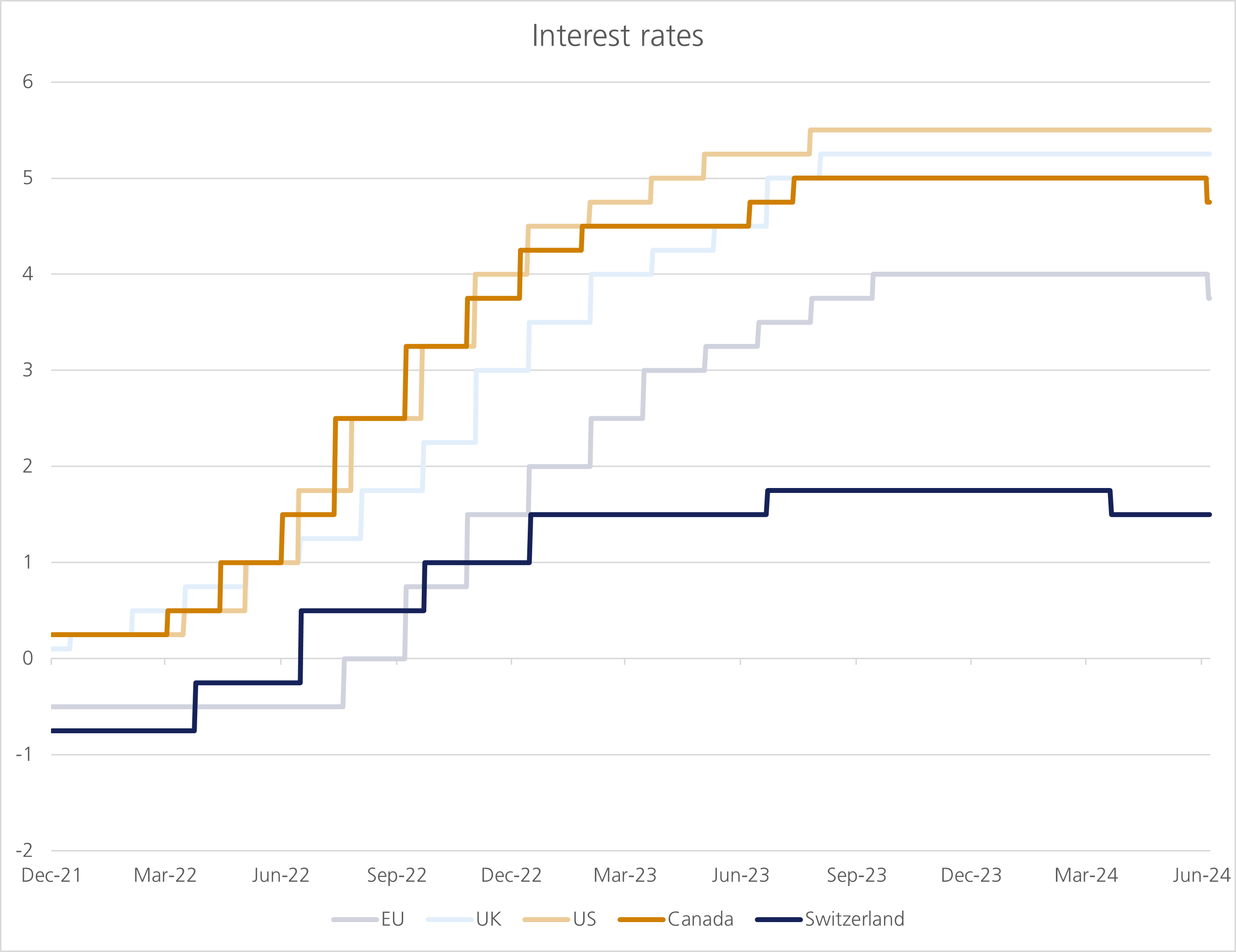

Coming into 2024, investors expected central banks to embark on significant rate cutting cycles, but stickier inflation and a resilient growth outlook pushed these expectations further out. From of all the major developed market central banks, the European Central Bank (ECB) provided the clearest signal that it sought to cut interest rates in short order. This is a luxury not available to the Federal Reserve (Fed) or the Bank of England (BoE), as inflation concerns are greater, resulting in the number of anticipated rate cuts in the US and UK declining throughout the year.

On Thursday, the ECB cut interest rates by 0.25%, marking the first decline in five years amid declining inflation and a sluggish economy. This brings the Eurozone’s main deposit rate from 4% to 3.75%.

As we marked the 80th anniversary of D-Day on 6th June, another war wages on Europe's borders following Russia’s invasion of Ukraine over two years ago. This military shock sent energy and food prices up, and the ensuing inflation led ECB to accelerate their hiking cycle. The ripple effects are still felt today, but the impact is waning. European reliance on Russian gas and the subsequent rationing and sanctions dealt a heavy blow to the German manufacturing model. Consequently, its economy has been in the doldrums for some time. Germany saw its economy shrink in the fourth quarter of last year and has only seen a modest uptick since. Economists now forecast that structural weakness will continue to weigh on Germany’s recovery. Meanwhile, southern Europe is having its time in the sun with Spain growing at healthy pace.

Europe’s uneven recovery led the ECB to focus on growth, as inflation concerns have abated. What remains unknown is how many rate cuts market participants can expect this year. Interest rates will not fall as fast as they went up, and market participants expect the ECB will cut rates two more times in 2024.

In Thursday’s press conference, ECB President Christine Lagarde said, “despite the progress over recent quarters, domestic price pressures remain strong as wage growth is elevated, and inflation is likely to stay above target well into next year”.1 She underscored how the ECB will continue to be data dependent, and will analyse the inflation outlook, underlying inflation and the strength of transmission of monetary policy before proceeding with further cuts.

The meeting had little effect on markets given the rate cuts were so well telegraphed.

Lagarde strived for strategic ambiguity given the potential for shocks as European Parliamentary elections are ongoing and broader geopolitical tensions.

The ECB’s move on Thursday follows similar rate cuts made by central banks in Switzerland, Sweden and Canada this year. It is likely the BoE will be the next major developed market central bank to cut rates, now expected in September, which would be welcomed and should help increase economic momentum. But the path to cutting interest rates is far from straightforward. Rising differences between interest rate across regions can weaken currencies, leading to imported inflation, a topic we explored in our Brief “European central banks: stuck in the middle?”. Europe also must contend with ongoing fragility in energy markets, as the continent is and will remain a net importer of natural gas and petroleum oil.2

While the starting gun on the rate cutting cycle has started, regional differences will result in a widening gap between central banks. Given that the Fed’s sphere of influence, this will mean central banks elsewhere will adopt a cautious approach and favour ambiguity over clear forward guidance.

[1] ECB, https://www.ecb.europa.eu/press/pr/date/2024/html/ecb.mp240606~2148ecdb3c.en.html

[2] Europa, https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20240322-2

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.