In the aftermath of the Russian invasion of Ukraine, western central banks became decidedly hawkish by initiating the fastest cycle of interest rate hikes in decades in an attempt to combat inflation. In contrast, Japan remained dovish, keeping interest rates low after decades of weak growth and deflation.

Over recent weeks, these roles appear to have reversed. Earlier this week, the Bank of Japan (BoJ) took steps to normalise their ultra-loose monetary policy by raising interest rates up to 0.25% from the 0-0.1% range previously, and Governor Kazuo Ueda indicated future rate hikes were on the cards. On the other hand, yesterday the Bank of England (BoE) took its first step in its rate cutting cycle, becoming the latest developed market central bank to lower rates.

In addition to raising rates twice this year, the BoJ also announced plans to curb purchases of Japanese government bonds, aiming to halve the number of purchases by early 2026.

After weakening to a 38-year low, the yen strengthened by 7% against the US dollar in July, as speculation of the BoJ’s action gathered steam. The yen remains meaningfully weaker this year which pushed import prices up, weighing on the Japanese consumers’ purchasing power. Japanese voters’ dissatisfaction with the government is becoming evident, as support for Prime Minister Fumio Kishida in June was at the lowest since he took office in 2021.1 (“What impact does inflation have on incumbents?”) To remain prime minister, he must stay on as president of the ruling Liberal Democratic Party (LDP), but his current term ends in September and it seems unlikely he will hold on.

As Japan engages in its interest rate hiking cycle, western central banks have begun to cut interest rates. On 1st August, the BoE voted to cut rates for the first time since 2020. In a finely balanced decision, they voted 5 to 4 to cut by 0.25%, bringing rates to 5%. In the press conference following the announcement, Governor Andrew Bailey remained ambiguous about future rate cuts, reiterating the BoE’s data dependence.

The BoE follows the steps of Sweden, Switzerland and Canada, with the Bank of Canada notably lowering its rate twice in just two months. We have commented previously of the power the Federal Reserve (Fed) wields. At its last meeting at the end of July, it met market expectations by providing the strongest indication that rate cuts are on the cards in September. This goes some way to explain how central banks are becoming increasingly confident about lowering interest rates. Fed Chair, Jerome Powell, said that while there was “no decision about future meetings”, he noted that the Federal Open Market Committee started to discuss rate cuts in the July meeting and said that if they receive the data they’re hoping to get, “then a reduction in the rate policy could be on the table at the September meeting.”2 He did not offer clarity on the speed of rate cuts, and also added that larger 0.50% cuts was not “something that we’re thinking about right now.”3

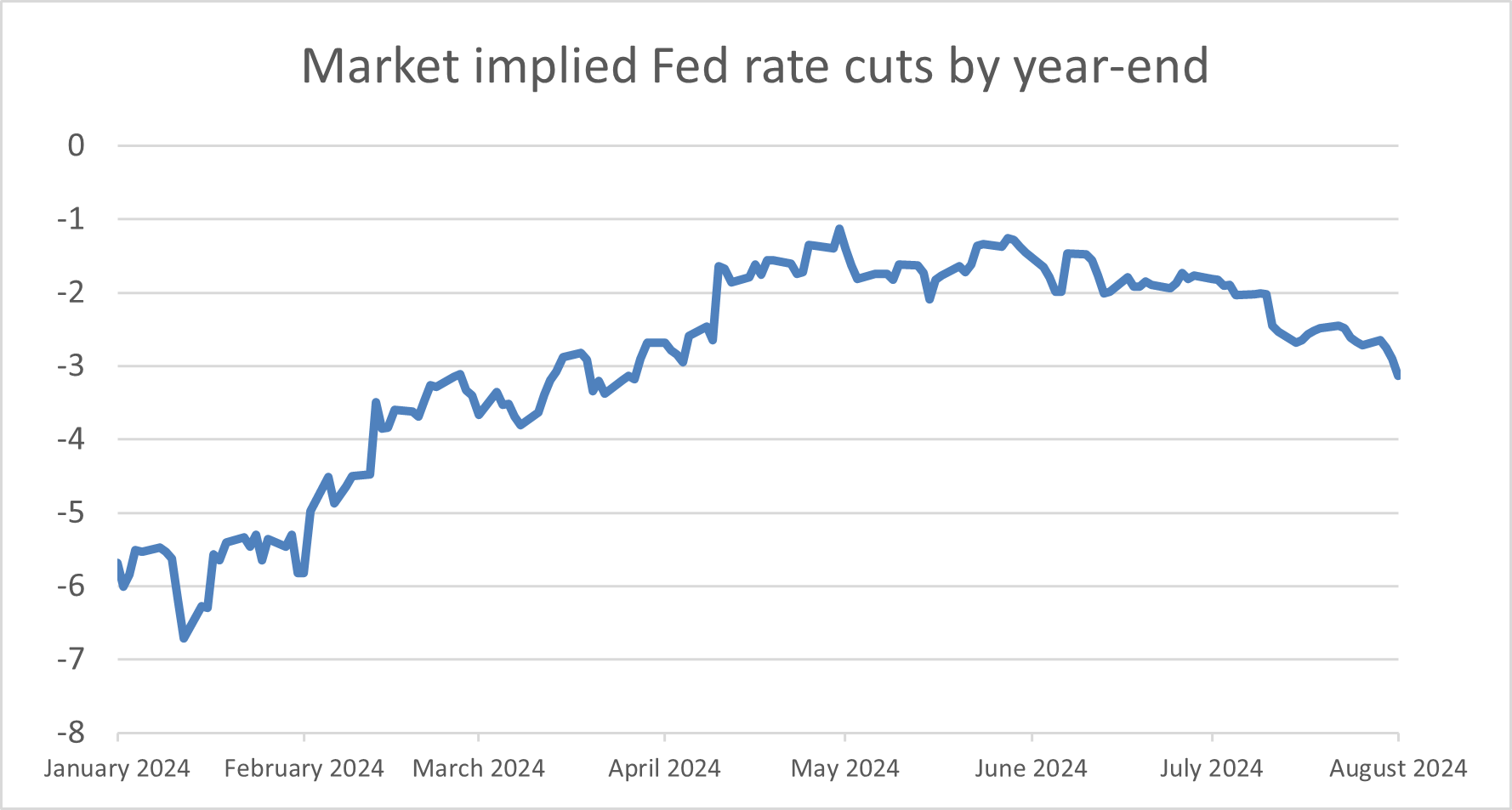

Both investors and central banks have fluctuated significantly in their expectations for interest rate cuts. Coming into the year, investors expected six quarter point rate cuts relative to Fed’s projection of three. As the year progressed, investor moved toward the Fed’s position, but unexpected inflationary pressures brought both parties closer to forecasting just one cut for the year. It seems we now have come full circle, with investors seeing three cuts, implying a 0.25% reduction at each of the remaining three Fed meetings this year. Meanwhile, the Bank of England is expected to cut rates once or twice this year, while the BoJ will continue to nudge rates higher.

While Japan is moving in the opposite direction to its developed market peers, the rate cutting cycle elsewhere will help mitigate the need for more tightening. Concern around the yen brought rate increases into sharper focus, given concerns of higher import prices leading to further wage increases. It seems the long-awaited rate cutting cycle is starting to broaden out, but expect central banks to proceed cautiously, given the experiences of the past few years and the geopolitical climate.

[1] Reuters, https://www.reuters.com/world/asia-pacific/voter-support-japan-pm-kishida-slips-new-low-nhk-poll-shows-2024-06-10/

[2] Deutsche Bank

[3] Deutsche Bank

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.