Warren Buffett famously stated that he plans to give away 99% of his wealth, leaving his children with enough to do anything, but not too much to do nothing. Many parents grapple with the question of how much to give and when to give it, ensuring that wealth enhances rather than hinders personal and professional development of the next generation.

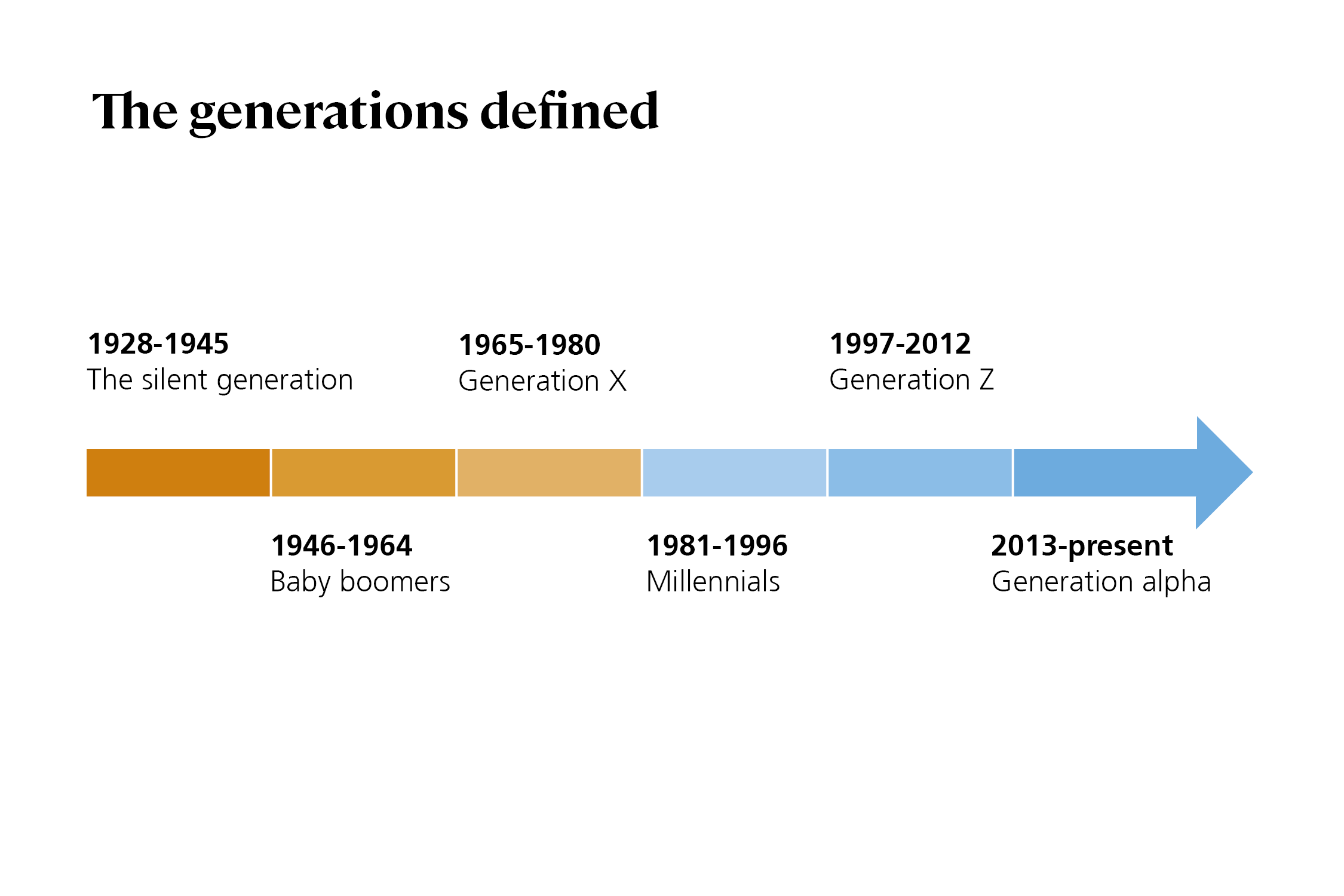

One of the most prominent mechanisms of intergenerational wealth transfer is what has come to be known as the "Bank of Mum and Dad" (BOMAD). The term, coined around 2014, reflects the growing reliance of younger generations on parental financial support, particularly in securing a footing on the property ladder and achieving financial security, a cultural phenomenon that has emerged only in the last century or so. The concept has since evolved beyond homeownership, extending into broader financial assistance such as education, business funding and general lifestyle support – as the younger generations, certainly millennials and increasingly Generation Z (“Gen Z”), lean on parents and guardians for support in these areas.

According to data from Legal & General, an increasing proportion of mortgages in the UK rely on parental contributions. In 2017 alone, the BOMAD funded a reported £2.3 billion in mortgage repayments on nearly 460,000 properties. In 2023, Millennials (those born between 1981 and 1996) finally reached a significant milestone, with a higher proportion of millennials now owning a home, rather than renting.1

In her book 'Inheritocracy', Eliza Filby outlined that the trend of BOMAD providing financial support is largely repeated in other countries, with 43% of homebuyers under 35 receiving assistance in the US and over 40% of millennials in Australia and China also benefiting from parental support when purchasing homes. With the rise in cost of living that we have seen over the last few years, this trend is unlikely to slow down in the near term.

The October 2024 UK Budget introduced significant changes to inheritance tax (IHT) rules that will dramatically reshape the landscape of wealth transfer in the future. From April 2027, pensions—which are currently outside the estate for IHT purposes—will become subject to taxation. Similarly, assets qualifying for Business Property Relief (BPR) and Agricultural Property Relief (APR) will face a 50% IHT rate from April 2026, with an allowance of £1 million per estate.

These changes underscore the need for proactive financial planning. Families must consider the timing and structuring of gifts, balancing tax efficiency with financial security.

Over the next thirty years, a record £7 trillion in wealth is due to be transferred to the next generation in the UK alone, which underscores the importance of getting succession planning right.2

The Bank of Mum and Dad is more than a convenient source of financial support; it is a cornerstone of multigenerational wealth transfer that is reshaping economic realities in the UK and globally. With rising inheritance tax implications, families must adopt a structured approach to gifting and succession planning. Whether through property purchases, education funding or broader financial support, the BOMAD will remain an essential factor in shaping the financial well-being of Millennials and Generation Z. As the largest wealth transfer in history unfolds, strategic planning, financial education and responsible wealth management will be crucial in ensuring that inherited assets enhance the quality of life without eroding ambition and personal growth.

[1] Source: 'Inheritocracy', book by Eliza Filby

[2] Source: Vanguard Analysis based on ONS 2020 Wealth and Assets Survey, and 2020 National and Subnational Mid-year Population Estimates for the UK, Demos: A new age of inheritance (January 2023)

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.