It’s only a slight oversimplification to say that what mattered most in equity markets in 2024 was: how much you were spending on AI, how much your AI clients were buying from you and how close your CEO was to the incoming US president.

To reiterate, it is not normal for half of the S&P 500’s annual performance to come from just seven names. It is even more unusual for 20% of gains to come from just one company, in this case AI chip manufacturer Nvidia. But this is what happened in 2024. These huge companies (Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta and Tesla) have been dubbed the Magnificent Seven and it’s not just their share prices that have been magnificent. Their operating businesses have also impressed. Apple’s operating profit rose 6% year-on-year in the recently reported quarter to the end of December, driven by 14% growth in their highly profitable services business, such as iCloud, the App Store and Apple Pay.

Alphabet’s Q4 2024 revenue rose 12%, and operating profit rose a whopping 30% as the company saw sales, general and advertising costs fall over the year. Meta faired even better, with 21% revenue and 43% operating profit growth.

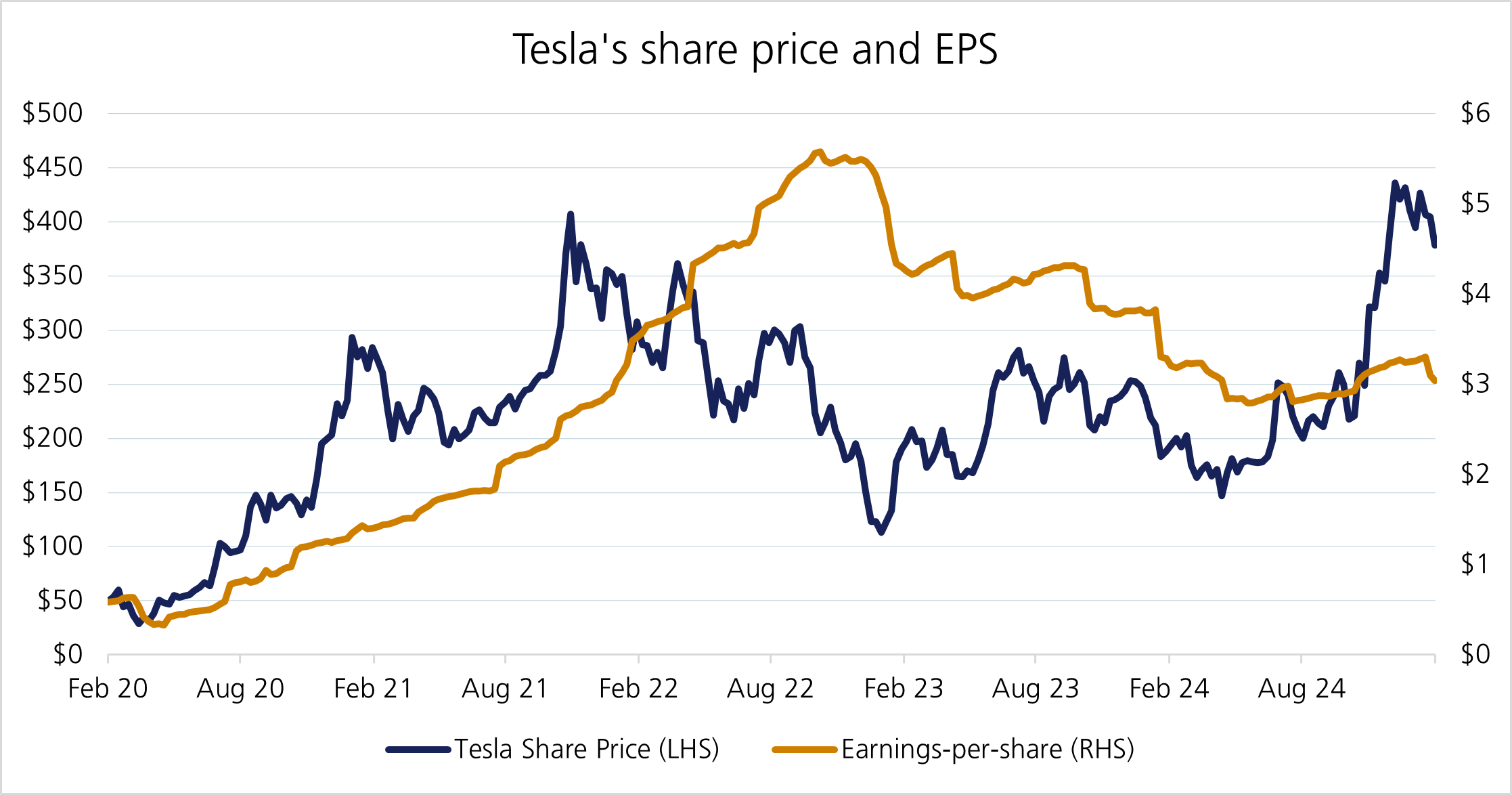

By contrast, Tesla saw only a 2% increase in revenue and a 23% decrease in operating profit as their average car prices continue to fall. Not that this affected the share price. (See the “How close was your CEO to the incoming US President” comment above).

And Amazon? They reported 11% revenue growth and a massive 60% increase in operating profit as their huge (and hugely profitable) cloud business grew another 19%.

It’s just as well these companies are seeing such impressive revenue and profit growth. Many say tech is the new oil, and those big tech firms have been consistently spending more on capital expenditure than energy major Exxon for the past five years. Way more. While Exxon spends $7-8 billion per quarter, Alphabet spent $14 billion in their latest quarter, Meta $14 billion, Microsoft $16 billion and Amazon $28 billion. If we include research and development costs too, then Alphabet spent $17 billion, Meta $23 billion, Microsoft $24 billion and Amazon an astonishing $54 billion. And that’s just in one quarter! As big technology companies race to stay ahead of the AI game they are investing huge amounts in infrastructure, and a lot of this is being spent on Nvidia’s AI chips. (Nvidia reports at the end of February.)

We believe these large technology companies are prudent to invest heavily in AI to increase the economic moat around their businesses and to ensure they remain at the cutting edge of this technology. That said, the seemingly much cheaper DeepSeek AI model released a couple of weeks ago, and the sheer size of their current AI spending demonstrates that these companies are not without risk. Does it also foretell an East/West split on AI? These are the biggest companies in the world with some of the largest revenues and highest profits. And yet, even they are spending substantial amounts of revenue on capex and research and development. Alphabet spent 28%, Meta 48%, Microsoft 34% and Amazon 27% in the most recent quarters. These substantial investments show that maintaining a competitive edge is not only a massive financial strain but also carries a degree of uncertainty, which could have long-term implications on their profitability.

Perhaps markets will be more selective in rewarding companies for their AI investment in 2025, given the volatility following the launch of DeepSeek’s model. Magnificent 7 stocks have recovered somewhat but questions are arising about some of these companies’ lofty valuations. Nvidia had $350 billion in market capitalisation wiped off in January, compared to Meta’s gain of $270 billion and Alphabet’s $180 billion. Concentration was the buzzword of 2024; will this year be about diversification? Perhaps the Magnificent Seven’s rise is Hollywood’s version of the Japanese classic, the Seven Samurai. However, time will tell if the ending will be the same—only three of the seven samurai were left standing by the end.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.