Earlier this week, a little-known Chinese artificial intelligence (AI) start-up called DeepSeek roiled markets by launching its competitor to ChatGPT. The powerful AI model was created with far less money than AI experts thought possible, which raised questions whether US companies would continue to invest vast amounts of money now that it has been proven these models can be built for less. In a span of just 24 hours, Nvidia fell nearly 17%, erasing $593 billion in market capitalisation in a single day.1 The S&P 500 fell 1.5% and the Nasdaq fell 3.1%.

But what we witnessed was about more than just DeepSeek’s disruption and remarkable achievement. It shows us how the astonishing technological advances coming out of China, India and emerging markets represent part of a larger decoupling occurring between the East and West, and also underscores the importance of diversification, given how swiftly these mega-companies can be challenged and unseated.

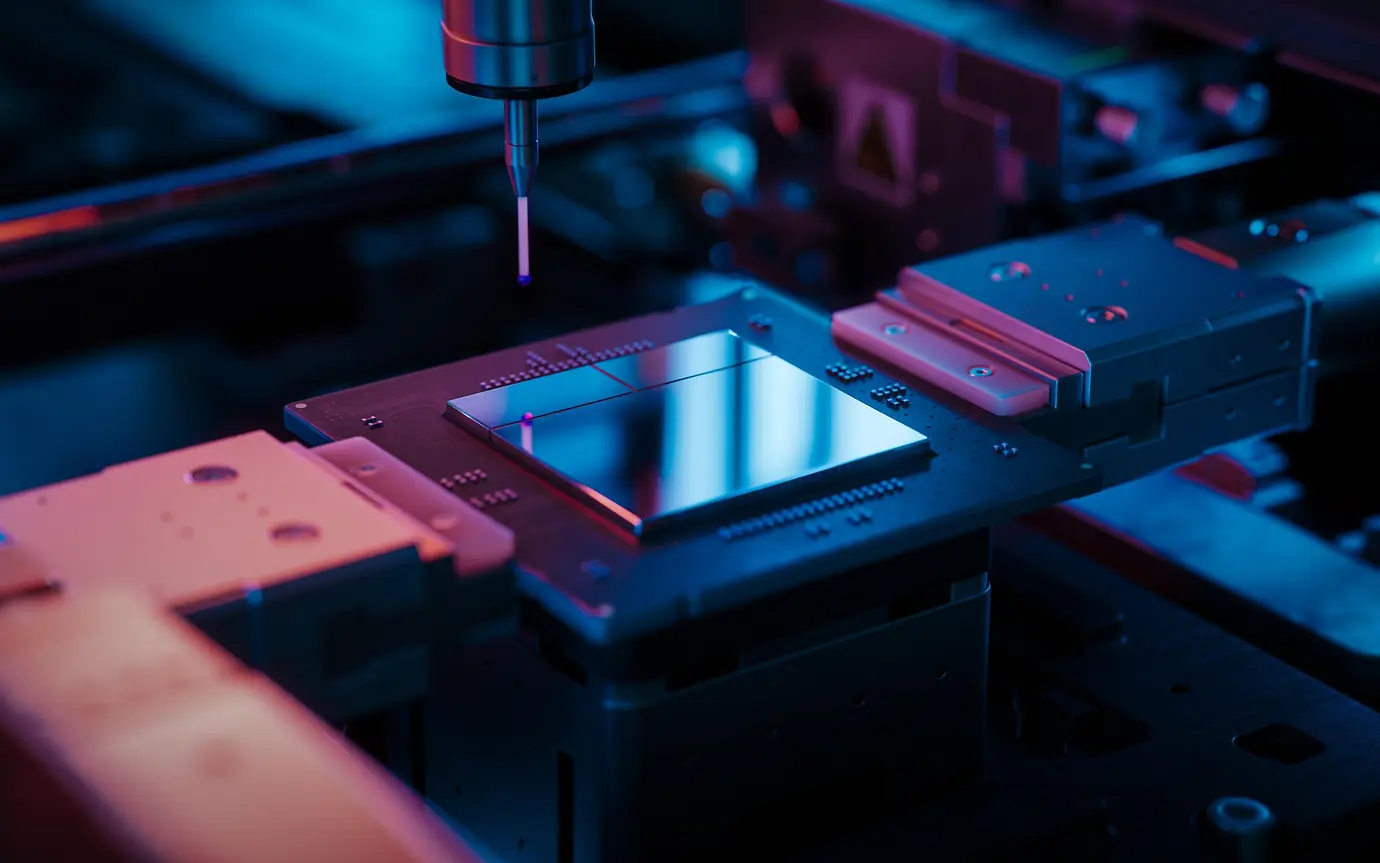

DeepSeek is a start-up founded and owned by Chinese stock trading firm High-Flyer, run by entrepreneur Liang Wenfeng. It aims to build AI technologies like OpenAI’s ChatGPT and Google’s Gemini. By 2021, DeepSeek’s founder had acquired thousands of computer chips from Nvidia, which are crucial in all efforts to create powerful AI systems.2

DeepSeek introduced its first free chatbot app, DeepSeek-V3, the day after Christmas 2024, which already matched some of the capabilities of the best chatbots made by OpenAI and Google. This alone would have been impressive. However, DeepSeek’s team said in a research paper that its model only used a fraction of the computer chips that leading AI companies relied on to train their systems. Typically, the world’s top companies train their chatbots with supercomputers that use 16,000 chips or more. DeepSeek’s engineers said they only needed about 2,000 chips.3 DeepSeek launched its most recent DeepSeek-R1 version on 20 January, which led to this week’s dramatic market reactions.

The prevailing notion among engineers and scientists was that powerful AI systems could not be built without investing billions of dollars in specialised AI chips. This meant that only the biggest technology companies—Microsoft, Google, and Meta—could afford the latest technology. But in their paper, DeepSeek engineers say they only need $6 million in raw computing power to train the new system, roughly ten times less than what Meta spent building its latest AI technology.4 This led to the aggressive sell-off in AI-related stocks earlier this week as investors raised questions about the lofty valuations of some of the Magnificent 7 companies, although technology stocks have recovered somewhat since.

Some argue that strict US AI chip export laws—which former President Joe Biden put in place in the last year or so—meant Chinese researchers have had to get creative with tools available on the internet, forcing Chinese developers to improve efficiency. DeepSeek’s significant leap forward could represent the unintended consequences of the US government’s trade restrictions.

China has had longstanding ambitions for technological independence. The Chinese government has been investing heavily in its domestic semiconductor and AI industries in response to the export restrictions from the US, which tightened the global supply chain. India is also making gains in this space, investing millions of dollars in AI innovation which could revolutionise sectors such as agriculture, healthcare, urban planning and manufacturing.5

According to the United Nations, Chinese investors filed the highest number of AI patents between 2014 and 2023 of any country.6 In that period, more than 38,000 Generative AI patents came out of China, more than six times as many as those filed by the United States. Generative AI, which allows users to create content including text, images, music of software code, powers several industrial and consumer products, including chatbots such as ChatGPT. History has shown that there is generally a positive relationship between patent filings and GDP growth—in other words, countries with many patents in sectors such as technology, pharmaceuticals, and manufacturing tend to have higher GDP.

Ultimately, we believe this will lead to a widening divide between the East and West, which represents opportunities for investors. If more companies enter the AI space, this will lead to greater competition and encourage faster technological advancements. It could also create innovation hubs around the world, challenging the original technology hub Silicon Valley.

The turbulence we’ve seen this week in AI-related stocks underscores the importance of remaining diversified. Overexposure to a select few stocks can leave investors exposed to volatility. Passive funds are locked into some of the largest names despite lofty valuations, but active managers can adjust their positions, avoid extreme concentration and find opportunities. Notably, during the AI-technology-related sell-off earlier this week, which led to the S&P 500 falling 1.5% in 24 hours, the other sectors outside of technology had a stronger day, with nearly 70% of S&P 500 companies moving higher.7 The last time we saw a similar dynamic was around the dot-com crash in 2000.

The ripple effect of DeepSeek’s innovation, however, extends far beyond individual companies, signalling a shift in global technological power dynamics, especially as China and India ramp up their AI capabilities, threatening the dominance of those few US tech firms which seemed invincible. The innovation race, coupled with an increasingly estranged East and West amid a new era in US politics, will unquestionably lead to a competitive and groundbreaking few years.

[1] Bloomberg, Deutsche Bank

[2] New York Times: https://www.nytimes.com/2025/01/27/technology/what-is-deepseek-china-ai

[3] New York Times: https://www.nytimes.com/2025/01/27/technology/what-is-deepseek-china-ai

[4] New York Times: https://www.nytimes.com/2025/01/27/technology/what-is-deepseek-china-ai

[5] World Economic Forum: https://www.weforum.org/stories/2025/01/ai-for-india-2030-blueprint-inclusive-growth-global-leadership/

[6] United Nations: https://news.un.org/en/story/2024/07/1151761

[7] Bloomberg, Deutsche Bank

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.