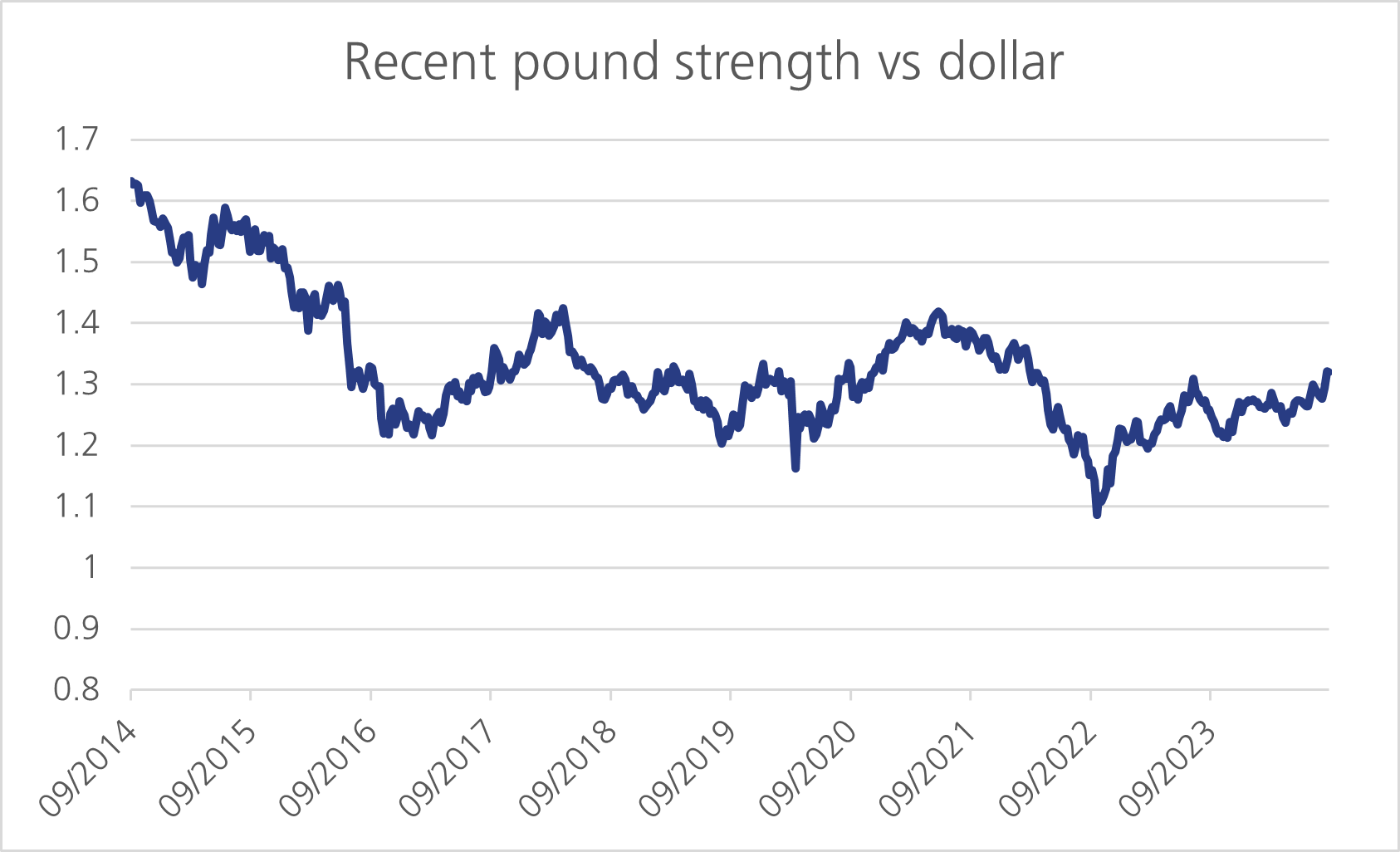

News that the pound has strengthened to its highest value against the dollar since March 2022 will be welcome to those enjoying the last of the summer holidays, as those pounds stretch further.

Since the UK’s decision to leave the European Union, the value of the pound has fluctuated – at times gaining strength only to lose it again soon after. This begs the question: will this increase in value last, or will it fade like before?

On Tuesday, Prime Minister Keir Starmer gave a speech warning that October’s budget “is going to be painful”, as he reiterated the claim that Labour inherited a £22 billion black hole from the previous Conservative government. When pressed, Starmer repeated his electoral pledge that there will be no increases on income tax, VAT or National Insurance, but did say those with “the broadest shoulders should bear the heavier burden”.1 Chancellor Rachel Reeves has not ruled out an increase on inheritance tax, capital gains tax, or reforming tax relief on pensions. The government also announced cost-cutting measures such as scrapping a cap on social-care payments and withdrawing the winter-fuel allowance for 10 million pensioners.

While speculation is mounting on what taxes will most likely rise, from a broader economic perspective, we are unlikely to see a stimulative fiscal policy stance any time soon. This likely means a lower of supply of UK government bonds, or Gilts, providing support to the pound. Furthermore, news of a better economic partnership between Germany and the UK highlights the potential for less trade friction which could boost long-term prospects.

The Federal Reserve’s (Fed) annual meeting in Jackson Hole has also had an impact on the value of the pound and the dollar. Last week, Chairman Jerome Powell laid the groundwork for a cut in interest rates at the Fed’s September meeting. Powell highlighted that inflation has been steadily declining since it peaked in 2022, and expressed confidence that it is on track to reach the Fed’s 2% target. He spent most of his speech reiterating the two-sided impacts of monetary policy, focusing on weaker labour market dynamics rather than inflation. The August Consumer Price Index reading came in at 2.9% for the year up to July, but more pertinently, shorter-term indicators showed a meaningful cooling of price pressures.2 The Fed’s mandate is for stable prices and maximum employment. Powell’s latest speech shows a clear shift of focus from the former to the latter.

In addition to keeping fiscal policy tight by raising taxes, the number of expected rate cuts by the Bank of England (BoE) has remained moderate. Earlier this month, members delivered a 0.25% cut. However, the UK’s inflation rate came in slightly higher than expected in August, with overall prices increasing by 2.2% this year through July, according to the Office for National Statistics (ONS).3 The BoE is now forecasting inflation will tick up to 2.75% over the coming months, before falling below 2% next year as favourable base effect diminish.

The divergence between forecasted interest rate cuts in the US, where markets currently price in that interest rates will decrease by 1% in the US by the end of the year compared to a further one or two 0.25% cuts in the UK, help explain why the pound has strengthened against the dollar.

The divergence between forecasted interest rate cuts in the US, where markets currently price in that interest rates will decrease by 1% in the US by the end of the year compared to a further one or two 0.25% cuts in the UK, help explain why the pound has strengthened against the dollar.

Last week, we covered the US presidential election and Kamala Harris’s and Donald Trump’s economic plans. While some Democrats initially expressed reservations about Harris, her popularity has grown more than expected. However, the race remains close, with FiveThiryEight giving Harris a slight advantage over Trump as November approaches.

The closeness of the race increases the chances of a divided Congress, which could limit government spending and make it difficult to pass new policies. Despite this, the current US fiscal approach remains more flexible than that of the UK, largely due to significant military and healthcare expenditures.

There are deeper factors contributing to sterling’s recent strength, but it is too early to say if these will fade over time. We continue to monitor the dollar/pound relationship very closely, but given the sharp, recent strength, we expect a breather until investors gain more confidence about the direction. For the moment, the interest rate differentials move in the UK’s favour, and the fiscal situation broadly favours the pound.

[1] BBC, https://www.bbc.com/news/articles/clyn01p5npgo

[2] Bureau for Labor Statistics

[3] Office for National Statistics, https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/july2024

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.